2026 Medicare Premium Adjustments: Your Essential Financial Guide

Understanding the 2026 Medicare premium adjustments is crucial for effective financial planning, as these changes directly impact healthcare costs for millions of Americans, demanding proactive review and strategic adaptation.

As we look ahead to 2026, understanding the nuances of 2026 Medicare premium adjustments becomes increasingly vital for millions of Americans. Medicare, a cornerstone of healthcare for those aged 65 and older, as well as younger individuals with certain disabilities, is subject to annual changes that can significantly impact personal finances. Navigating these adjustments effectively requires a proactive approach and a clear understanding of what to expect.

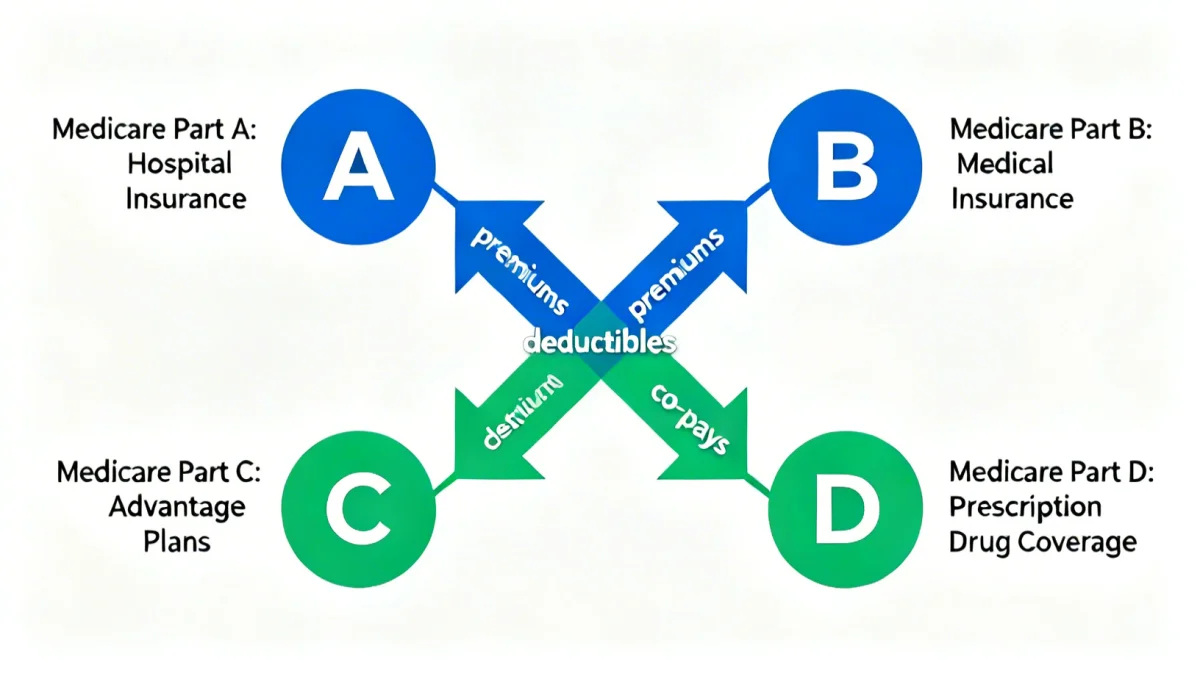

The Foundations of Medicare: Parts A, B, C, and D

Before delving into the specific adjustments for 2026, it is essential to grasp the fundamental structure of Medicare. This federal health insurance program is divided into distinct parts, each covering different services and carrying its own cost structure. Understanding these parts forms the bedrock of comprehending any future premium changes.

Medicare Part A, often referred to as Hospital Insurance, primarily covers inpatient hospital stays, skilled nursing facility care, hospice care, and some home health services. For most beneficiaries, there is no premium for Part A if they or their spouse paid Medicare taxes for a sufficient period while working. However, if you haven’t met these requirements, you might need to pay a premium. Part B, or Medical Insurance, covers doctor’s services, outpatient care, medical supplies, and preventive services. This is where most beneficiaries encounter their primary monthly premium. Part C, known as Medicare Advantage, is an alternative to Original Medicare (Parts A and B) offered by private companies approved by Medicare. These plans bundle Part A, Part B, and often Part D (prescription drug coverage) and may include extra benefits like vision, dental, and hearing. Lastly, Part D provides prescription drug coverage, also offered through private insurance companies.

Medicare Part A: Hospital Insurance

While most individuals do not pay a premium for Part A, it’s important to understand the criteria. If you’ve worked and paid Medicare taxes for at least 10 years (40 quarters), you’re typically premium-free. If not, the premium can be substantial, reflecting the cost of hospital care. For 2026, any adjustments to this premium for those who pay will likely reflect broader healthcare cost trends and legislative changes.

- Premium-free eligibility based on work history.

- Potential monthly premium for those with fewer than 40 quarters of Medicare-covered employment.

- Covers inpatient hospital stays and skilled nursing care.

The premium for Part A, when applicable, is a critical consideration for those who do not meet the 40-quarter work requirement. These individuals must budget for this significant cost, which is determined annually based on average hospital costs. Future adjustments will be based on similar actuarial analyses and Medicare’s financial outlook.

Decoding Medicare Part B Premium Adjustments for 2026

Medicare Part B premiums are arguably the most impactful annual adjustment for the majority of beneficiaries. These premiums are typically deducted directly from Social Security benefits, making any changes immediately noticeable. Several factors influence the Part B premium, including the Social Security Act, the Medicare Trustees’ reports, and legislative actions.

The standard Part B premium is determined by the Centers for Medicare & Medicaid Services (CMS) each year, usually announced in the fall. However, high-income beneficiaries pay a higher amount, known as the Income-Related Monthly Adjustment Amount (IRMAA). IRMAA is based on your Modified Adjusted Gross Income (MAGI) from two years prior. So, for 2026 premiums, your 2024 income will be the determining factor. This means that significant income changes in previous years could lead to unexpected premium increases in the future.

Factors Influencing Part B Premiums

The primary drivers behind Part B premium adjustments are usually the projected costs of physician services, outpatient hospital care, and other medical services covered by Part B. Economic inflation, advancements in medical technology, and changes in healthcare utilization all play a role. Additionally, the solvency of the Medicare trust funds is a constant consideration for policymakers.

- Projected healthcare spending increases.

- Inflation rates for medical services.

- Legislative changes impacting Medicare funding.

Understanding these underlying factors is key to anticipating future premium hikes. Monitoring economic indicators and legislative discussions can provide early insights into potential changes. The annual announcement from CMS will provide the definitive figures, but being prepared for potential increases is always wise.

The Impact of IRMAA: High-Income Surcharges in 2026

The Income-Related Monthly Adjustment Amount (IRMAA) is a critical component of Medicare Part B and Part D premiums for higher-income individuals. As mentioned, IRMAA is based on your MAGI from two years prior, meaning your 2024 income will dictate your 2026 IRMAA. This surcharge can significantly increase your monthly Medicare costs, and it’s essential to understand how it’s calculated and how it might affect your financial planning.

IRMAA tiers are adjusted annually, but the underlying principle remains constant: the more you earn, the higher your Medicare premiums will be. For 2026, the income thresholds for these tiers will be updated, reflecting inflation and other economic factors. These thresholds are particularly important for retirees who may have fluctuating income from investments, pensions, or part-time work. A single large capital gain in 2024, for example, could push you into a higher IRMAA bracket for 2026, even if your income subsequently decreases.

Navigating IRMAA: Strategies and Considerations

Proactive financial planning can help mitigate the impact of IRMAA. Understanding your MAGI and how various income sources contribute to it is the first step. Strategies might include tax-efficient withdrawal strategies from retirement accounts, careful timing of capital gains, or managing distributions from Roth conversions. For those experiencing a life-changing event, such as retirement, divorce, or death of a spouse, there’s an appeals process to request a reduction in IRMAA.

- Monitor your Modified Adjusted Gross Income (MAGI).

- Consider tax planning strategies to manage IRMAA.

- Understand the appeals process for life-changing events.

Staying informed about the IRMAA thresholds and planning your income carefully can help minimize unexpected premium increases. It’s not just about earning less, but about earning smarter, especially in the years leading up to and during retirement. Consulting with a financial advisor specializing in retirement planning can be invaluable in this regard.

Medicare Advantage (Part C) and Part D Premium Outlook for 2026

While Original Medicare (Parts A and B) premiums are set by the government, Medicare Advantage (Part C) and Part D (prescription drug plans) premiums are offered by private insurance companies. This means that while there isn’t a single, universal premium adjustment for these parts, beneficiaries can expect changes in plan offerings and costs each year. These adjustments are driven by market competition, healthcare utilization trends, and the specific benefits offered by each plan.

For Medicare Advantage plans, premiums can range from $0 to substantial amounts, depending on the plan’s benefits, network, and geographic location. These plans often include additional benefits not covered by Original Medicare, such as dental, vision, and wellness programs. Part D plans also vary widely in their premiums, formularies (lists of covered drugs), deductibles, and co-pays. Both types of plans undergo annual review, and their benefits and costs are typically announced during the Annual Enrollment Period (AEP) in the fall for the upcoming year.

Beneficiaries should carefully review their current plan’s Annual Notice of Change (ANOC) and compare it with other available plans during the AEP. Even if you are satisfied with your current plan, it’s crucial to ensure it still meets your healthcare and financial needs for the upcoming year. New plans with better benefits or lower costs may become available, or your current plan’s formulary might change, affecting your prescription drug coverage.

Key Considerations for Part C and D

- Review Annual Notice of Change (ANOC) from your current plan.

- Compare plan benefits, networks, and costs during AEP.

- Assess changes in formularies for Part D plans.

The competitive nature of the private insurance market means that plan offerings are constantly evolving. What was the best plan for you one year might not be the most suitable the next. This necessitates an annual review to ensure you are enrolled in a plan that provides the best value and coverage for your individual circumstances.

Strategies for Managing Your Medicare Costs in 2026

With the inevitable adjustments to Medicare premiums and out-of-pocket costs, developing a robust strategy for managing these expenses is paramount. Financial planning for healthcare in retirement is not a one-time event but an ongoing process that requires regular review and adaptation. Being proactive can help mitigate financial surprises and ensure access to necessary care without undue burden.

One primary strategy involves meticulous budgeting. Understanding all potential Medicare costs, including premiums for Parts A, B, C, and D, as well as deductibles, co-pays, and co-insurance, allows for a more accurate financial picture. Building an emergency fund specifically for healthcare costs can also provide a crucial safety net. Additionally, exploring supplemental coverage options, such as Medigap (Medicare Supplement Insurance) plans, can help cover some of the out-of-pocket expenses not paid by Original Medicare. Medigap plans are standardized and offered by private companies, helping to cover deductibles, co-payments, and even foreign travel emergencies.

Financial Planning Tips for Medicare Beneficiaries

Beyond budgeting, consider the long-term implications of your healthcare decisions. For instance, maintaining good health through preventive care can reduce future medical expenses. Regularly reviewing your prescription drug needs and comparing Part D plans can lead to significant savings. For those with limited income and resources, exploring Medicare Savings Programs and Extra Help for prescription drug costs can provide crucial financial assistance.

- Create a detailed healthcare budget.

- Explore Medigap plans for supplemental coverage.

- Investigate Medicare Savings Programs and Extra Help.

Effective management of Medicare costs hinges on a combination of informed decision-making, proactive planning, and diligent review of available options. It’s about being an engaged participant in your healthcare journey, rather than a passive recipient of services. This proactive approach ensures financial stability in the face of evolving healthcare costs.

Anticipating Legislative and Economic Influences on 2026 Premiums

Medicare premium adjustments are not solely based on healthcare utilization but are also heavily influenced by broader legislative actions and economic conditions. Policymakers continuously debate reforms and funding mechanisms for Medicare, and these discussions can directly translate into changes in premiums, deductibles, and benefits. Understanding the political and economic landscape can provide valuable context for anticipating future adjustments.

Economic factors such as inflation, the overall health of the U.S. economy, and the solvency of the Medicare trust funds play a significant role. High inflation, for example, can drive up the cost of medical services and supplies, leading to higher premiums. Similarly, if the Medicare trust funds are projected to face financial shortfalls, legislative measures might be introduced to shore up their finances, potentially impacting beneficiary costs. These measures could include changes to how premiums are calculated, adjustments to IRMAA thresholds, or modifications to covered benefits.

Key Influences to Monitor

Keeping an eye on government reports, such as the annual Medicare Trustees’ Report, offers insights into the program’s financial health and future projections. Political debates surrounding healthcare reform, prescription drug pricing, and federal budget allocations are also important indicators. These discussions often signal potential future changes that could affect beneficiaries.

- Medicare Trustees’ Report findings.

- Healthcare reform debates in Congress.

- Economic inflation and its impact on medical costs.

Staying informed about these broader influences allows for a more comprehensive understanding of why Medicare premiums change and what might be expected in the future. It empowers beneficiaries and their families to plan more effectively, adapting their financial strategies to the evolving healthcare landscape.

| Key Aspect | Brief Description |

|---|---|

| Part B Premiums | Monthly cost for medical services, influenced by healthcare spending and inflation. |

| IRMAA | Income-Related Monthly Adjustment Amount for high-income beneficiaries (2024 MAGI for 2026). |

| Part C & D | Premiums and benefits for private plans vary annually; require careful review during AEP. |

| Financial Planning | Budgeting, Medigap, and exploring assistance programs are key strategies for managing costs. |

Frequently Asked Questions About 2026 Medicare Premiums

Medicare Part B premiums for 2026 are determined by the Centers for Medicare & Medicaid Services (CMS) based on projected healthcare spending, inflation, and the financial health of the Medicare trust funds, typically announced in the fall of 2025.

IRMAA (Income-Related Monthly Adjustment Amount) is a surcharge on Part B and Part D premiums for higher-income beneficiaries. For 2026, it will be based on your Modified Adjusted Gross Income (MAGI) from your 2024 tax return.

Yes, Medicare Advantage (Part C) premiums are set by private insurance companies and can change annually. Beneficiaries should review their plan’s Annual Notice of Change and compare options during the Annual Enrollment Period (AEP).

To manage costs, consider creating a healthcare budget, exploring Medigap plans for supplemental coverage, and investigating Medicare Savings Programs or Extra Help if you have limited income and resources. Proactive planning is key.

Official information regarding 2026 Medicare premium adjustments will be released by the Centers for Medicare & Medicaid Services (CMS) and the Social Security Administration, typically in the fall of 2025, through their official websites and publications.

Conclusion

As we navigate the complexities of healthcare, understanding the 2026 Medicare premium adjustments is more than just an administrative task; it’s a critical component of sound financial planning. The annual changes across Parts A, B, C, and D, coupled with the impact of IRMAA, necessitate a proactive and informed approach. By staying informed about official announcements, monitoring personal income, and exploring all available options for supplemental coverage and financial assistance, beneficiaries can effectively manage their healthcare costs. This diligence ensures that Medicare continues to provide the essential health coverage needed, without creating undue financial strain. Preparing for these adjustments now will empower you to make the best decisions for your health and financial well-being in 2026 and beyond.