Maximizing Medicare Benefits 2026: New Options & Deadlines

Understanding and maximizing your Medicare benefits in 2026 is crucial for securing comprehensive healthcare coverage, with new options and critical enrollment deadlines requiring careful attention and proactive planning.

Navigating the complexities of healthcare can be daunting, especially when it comes to Medicare. For many, understanding how to best utilize and maximize their benefits is key to ensuring peace of mind and access to quality care. This guide focuses on

Maximizing Your Medicare Benefits in 2026: A Guide to New Coverage Options and Enrollment Deadlines., providing clarity and actionable insights for beneficiaries across the United States.

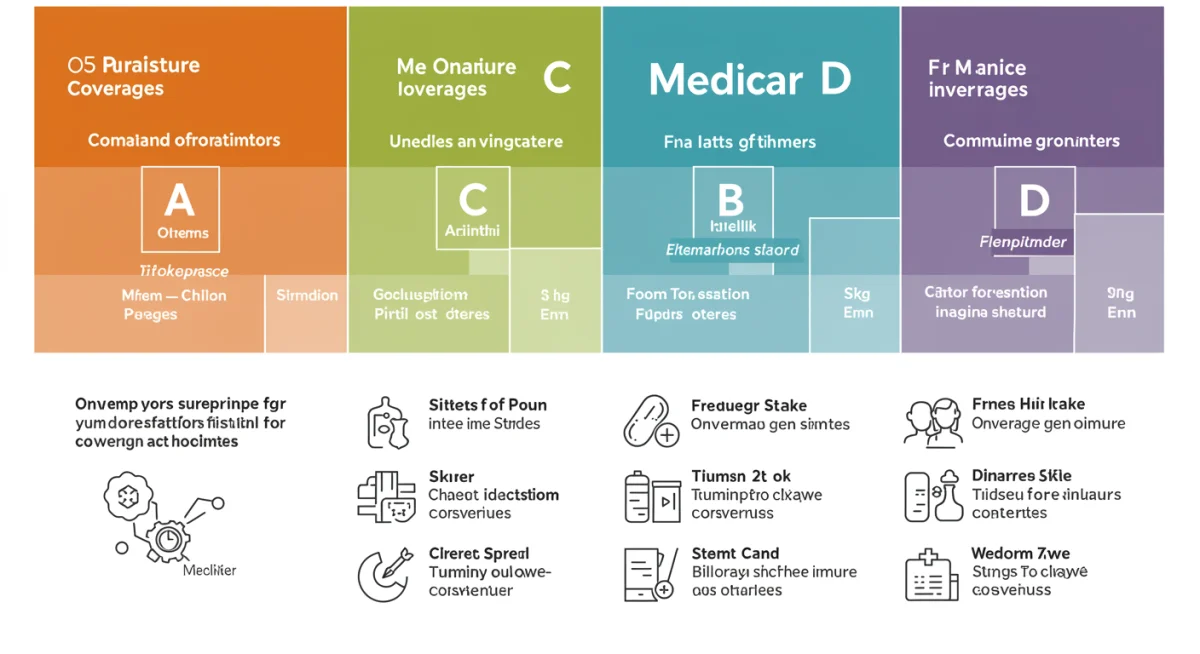

Understanding the Evolving Medicare Landscape for 2026

The Medicare program is dynamic, with adjustments made annually to better serve its beneficiaries. For 2026, several significant changes are anticipated, impacting everything from premium costs to covered services. Staying informed about these shifts is the first step toward effectively maximizing your Medicare benefits. These changes often reflect broader healthcare trends, technological advancements, and shifts in policy, all designed to enhance the quality and accessibility of care.

Understanding these evolving aspects is not just about compliance; it’s about empowerment. Knowing what’s new allows you to make informed decisions that directly affect your health and financial well-being. Ignorance of these updates can lead to missed opportunities for better coverage or unnecessary expenses, underscoring the importance of proactive engagement with Medicare information.

Key Policy Adjustments and Their Impact

- Premium and Deductible Changes: Anticipated adjustments to Part A, Part B, and Part D premiums and deductibles.

- Expanded Preventive Services: Potential inclusion of new preventive screenings or services to promote proactive health management.

- Telehealth Integration: Further expansion and clarification of telehealth services coverage, reflecting their increased use and effectiveness.

- Drug Cost Reductions: Continued efforts to lower prescription drug costs through negotiation and caps, potentially affecting Part D plans.

These adjustments are not arbitrary; they are the result of extensive research, public feedback, and legislative processes aimed at refining the Medicare system. Beneficiaries should review official Medicare communications and resources to get the most accurate and up-to-date information regarding these policy shifts. By doing so, you can align your current coverage with the new landscape, ensuring your plan remains optimal for your specific health needs.

In conclusion, the evolving Medicare landscape for 2026 presents both challenges and opportunities. A thorough understanding of these changes is essential for all beneficiaries. This foundational knowledge will empower you to navigate the upcoming year with confidence, ensuring your healthcare coverage remains robust and responsive to your needs.

Navigating New Coverage Options: What’s Available in 2026?

As Medicare evolves, so do the coverage options available to beneficiaries. For 2026, expect to see new plans, enhanced benefits, and possibly new categories of covered services. These additions are designed to offer more flexibility and comprehensive care, catering to a wider range of health needs and preferences. Exploring these new options is a critical part of maximizing your Medicare benefits.

The advent of new coverage options often means more choices for beneficiaries, which can be both a blessing and a challenge. While increased options provide opportunities for better-tailored plans, they also necessitate a more careful review process. Understanding the nuances of each new offering is paramount to selecting a plan that truly meets your individual health and financial requirements.

Medicare Advantage (Part C) Innovations

Medicare Advantage plans continue to be a popular choice, offering an all-in-one alternative to Original Medicare. For 2026, these plans are expected to introduce even more innovative benefits. These enhancements often go beyond traditional medical care to address broader aspects of health and well-being.

- Expanded Supplemental Benefits: Expect more plans to offer benefits like gym memberships, healthy food allowances, and transportation to medical appointments.

- Chronic Condition Support: Increased focus on plans tailored for individuals with specific chronic conditions, offering specialized care coordination and benefits.

- Telehealth Advancements: Further integration of virtual care options, making healthcare more accessible from home.

These innovations in Medicare Advantage plans reflect a growing understanding of holistic health, where social determinants and lifestyle factors play a significant role. Choosing an Advantage plan that aligns with your specific health goals and lifestyle can lead to substantial improvements in your overall well-being and a more cost-effective healthcare experience.

The new coverage options in 2026 provide ample opportunities for beneficiaries to find plans that better suit their needs. Whether through Original Medicare with supplemental plans or an all-encompassing Medicare Advantage plan, the key is to assess what’s available and how it aligns with your personal health journey. This diligent review ensures you’re truly maximizing your Medicare benefits.

Essential Enrollment Deadlines and Periods for 2026

Missing an enrollment deadline for Medicare can have significant consequences, including delayed coverage or potential late enrollment penalties. For 2026, understanding the various enrollment periods is crucial for all beneficiaries, whether you’re new to Medicare or looking to make changes to your existing plan. These periods are specifically designed to give individuals ample opportunity to enroll or adjust their coverage without interruption.

The structure of Medicare enrollment periods is designed to manage the flow of applications and changes efficiently. However, this structure can also be a source of confusion. Therefore, a clear understanding of when and how to act during these periods is not just recommended, but essential for maintaining continuous and appropriate coverage. Procrastination can lead to gaps in coverage or higher costs.

Key Enrollment Periods to Mark on Your Calendar

- Initial Enrollment Period (IEP): This seven-month period begins three months before your 65th birthday, includes your birthday month, and extends three months after. It’s your first chance to sign up for Medicare Part A and/or Part B.

- General Enrollment Period (GEP): If you miss your IEP, you can sign up for Part A and/or Part B during the GEP, which runs from January 1 to March 31 each year. Coverage starts July 1, and you might face late enrollment penalties.

- Annual Enrollment Period (AEP): From October 15 to December 7 each year, you can switch Medicare Advantage plans, change Part D plans, or switch between Original Medicare and Medicare Advantage.

- Special Enrollment Periods (SEP): These periods are available under specific circumstances, such as moving to a new service area, losing other coverage, or qualifying for Extra Help.

It’s vital to review your current plan’s performance and compare it against new offerings during the AEP. This annual review is a prime opportunity for maximizing your Medicare benefits by ensuring your plan still aligns with your health needs and budget. Don’t assume your current plan will remain the best option; changes in your health or in the plan’s structure could make a different choice more advantageous.

In summary, being aware of and adhering to the essential enrollment deadlines and periods for 2026 is critical. Marking these dates on your calendar and proactively reviewing your options will help you avoid penalties and ensure seamless, appropriate coverage. This diligence is a cornerstone of maximizing your Medicare benefits.

Strategies for Optimizing Your Medicare Choices

With the array of Medicare options available, making the right choices can feel overwhelming. However, adopting a strategic approach can simplify the process and ensure you select the plans that truly maximize your Medicare benefits. This involves a combination of self-assessment, research, and understanding the fine print of each plan. The goal is not just to have coverage, but to have the most effective and efficient coverage possible for your unique situation.

Optimizing your Medicare choices is an ongoing process, not a one-time decision. Your health needs, financial situation, and the Medicare landscape itself can change over time. Therefore, the strategies employed should be adaptable and revisited periodically to ensure continued alignment with your evolving requirements. This proactive management is key to long-term satisfaction with your healthcare plan.

Evaluating Your Healthcare Needs and Budget

Before diving into plan comparisons, take stock of your current health status, anticipated medical needs, and financial capacity. This personal assessment forms the foundation of smart Medicare planning. Consider factors such as your preferred doctors, specialists you see regularly, and any prescription medications you take.

- Assess Health Status: Document current health conditions, chronic illnesses, and any expected medical procedures.

- Review Prescription Needs: Make a comprehensive list of all medications, including dosages, to compare against plan formularies.

- Evaluate Doctor Network: Confirm if your preferred doctors and specialists are in-network with potential plans.

- Set a Budget: Determine what you can comfortably afford for premiums, deductibles, copayments, and out-of-pocket maximums.

Once you have a clear picture of your needs and budget, you can more effectively narrow down your options. For example, if you have several chronic conditions, a Medicare Advantage plan with strong chronic care management programs might be more beneficial than Original Medicare with a separate Medigap policy. Conversely, if you value flexibility and don’t mind managing separate plans, Original Medicare could be a better fit.

In essence, optimizing your Medicare choices requires diligent self-reflection and a clear understanding of your priorities. By aligning your healthcare needs and budget with the available plans, you can make informed decisions that lead to the most comprehensive and cost-effective coverage, truly maximizing your Medicare benefits.

Understanding Medicare Part D and Prescription Drug Coverage

Prescription drug costs can be a significant concern for many Medicare beneficiaries. Medicare Part D plans are designed to help cover these costs, but navigating the various options and formularies can be complex. For 2026, understanding how Part D works, potential changes, and how to choose the right plan is vital for maximizing your Medicare benefits and managing out-of-pocket expenses.

Part D plans are offered by private insurance companies approved by Medicare, and their offerings can vary widely in terms of covered drugs, premiums, deductibles, and copayments. This variability necessitates careful comparison to ensure the chosen plan aligns with your specific medication needs. A suboptimal Part D plan can lead to unexpected and substantial out-of-pocket costs.

Key Considerations for Part D Selection

When selecting a Part D plan, several factors come into play. It’s not just about the lowest premium; it’s about the best overall value for your specific prescription needs. A thorough review of these elements will help you make an informed decision.

- Formulary Check: Ensure all your current and anticipated prescription drugs are on the plan’s formulary (list of covered drugs).

- Tiered Costs: Understand the different drug tiers and what your copay will be for each tier. Generic drugs are typically in lower tiers with lower costs.

- Deductible and Coinsurance: Compare the annual deductible and how coinsurance works after the deductible is met.

- Pharmacy Network: Verify that your preferred pharmacies are part of the plan’s network, and check for preferred pharmacy options that might offer lower costs.

- Coverage Gap (Donut Hole): Understand how the coverage gap works and what your costs might be during this phase.

The government continues to implement measures to reduce prescription drug costs, and these changes may impact Part D plans in 2026. Keep an eye on official Medicare announcements regarding drug price negotiations and out-of-pocket spending caps, as these could significantly alter the landscape of prescription drug coverage. Such changes are designed to provide greater financial relief to beneficiaries.

In conclusion, a meticulous approach to Medicare Part D is essential for maximizing your Medicare benefits. By carefully comparing formularies, costs, and networks, you can select a plan that effectively manages your prescription drug expenses, ensuring you have access to the medications you need without undue financial burden.

Leveraging Preventive Care and Wellness Programs in 2026

One of the most effective ways to maximize your Medicare benefits is by actively taking advantage of the preventive care and wellness programs offered. These services are designed not only to detect health issues early but also to promote overall well-being, potentially preventing more serious and costly conditions down the line. For 2026, there may be even more opportunities to engage with these beneficial programs.

Preventive care is a cornerstone of modern healthcare, shifting the focus from treating illness to maintaining health. Medicare’s emphasis on these services reflects a broader understanding that proactive health management leads to better outcomes and a higher quality of life for beneficiaries. Ignoring these benefits is akin to leaving money on the table, as they are often covered at little to no cost.

Essential Preventive Services Covered by Medicare

Medicare covers a wide array of preventive services, many of which are provided at no cost if you receive them from a participating provider. Knowing what’s covered can help you schedule these important appointments and stay ahead of potential health problems.

- Annual Wellness Visit: A yearly appointment to discuss your health and develop a personalized prevention plan.

- Screenings: Regular screenings for conditions like cancer (colorectal, breast, cervical), diabetes, cardiovascular disease, and osteoporosis.

- Vaccinations: Flu shots, pneumonia shots, and Hepatitis B vaccines are generally covered.

- Counseling Services: For obesity, smoking cessation, alcohol misuse, and depression.

Beyond these standard preventive services, many Medicare Advantage plans in 2026 are expected to expand their wellness program offerings. These could include fitness classes, nutrition counseling, and even stress management programs. Such programs empower beneficiaries to take a more active role in their health, leading to improved physical and mental well-being. Engaging with these programs can significantly enhance your quality of life.

To summarize, leveraging preventive care and wellness programs is a smart strategy for maximizing your Medicare benefits. By utilizing these often no-cost services, you can maintain better health, detect issues early, and ultimately reduce your overall healthcare expenditures. Make it a priority to understand and use these valuable resources available to you in 2026.

Resources and Support for Medicare Beneficiaries in 2026

Navigating Medicare can sometimes feel like a solo journey, but a wealth of resources and support systems are available to help beneficiaries make informed decisions and get the most out of their coverage. For 2026, these resources continue to be invaluable tools for understanding new options, addressing concerns, and resolving issues. Knowing where to turn for help is a critical component of maximizing your Medicare benefits.

These support systems are designed to bridge the information gap and provide personalized assistance, recognizing that each beneficiary’s situation is unique. From official government websites to local community organizations, the aim is to ensure that no one feels lost or overwhelmed by the complexities of Medicare. Utilizing these resources can save time, reduce stress, and lead to better healthcare outcomes.

Key Resources for Medicare Assistance

Several reputable sources offer free and reliable information and support. Familiarizing yourself with these resources can empower you to confidently manage your Medicare journey.

- Official Medicare Website (Medicare.gov): The primary source for comprehensive information on all parts of Medicare, plan comparisons, and enrollment details.

- State Health Insurance Assistance Programs (SHIP): These programs offer free, unbiased counseling to Medicare beneficiaries and their families.

- Social Security Administration (SSA): Handles Medicare enrollment for most individuals and provides information on eligibility.

- Beneficiary and Family Centered Care-Quality Improvement Organizations (BFCC-QIOs): Helps with quality of care reviews and appeals.

- Local Senior Centers and Community Organizations: Often provide workshops, one-on-one counseling, and support groups related to Medicare.

Beyond these direct resources, consider consulting with trusted financial advisors or elder law attorneys who specialize in healthcare planning. While these services may come with a cost, they can provide invaluable personalized guidance, especially for complex situations involving long-term care or significant financial assets. Their expertise can help integrate Medicare planning into a broader financial strategy.

In conclusion, never hesitate to seek assistance when navigating your Medicare options. The resources and support available for 2026 are extensive and designed to help you make the best choices for your health and financial future. By actively engaging with these tools, you can ensure you are fully maximizing your Medicare benefits and securing the care you deserve.

| Key Aspect | Brief Description |

|---|---|

| Policy Changes 2026 | Anticipated adjustments to premiums, deductibles, expanded preventive services, and telehealth integration. |

| New Coverage Options | Innovations in Medicare Advantage (Part C) with expanded supplemental benefits and chronic condition support. |

| Enrollment Deadlines | Crucial periods like IEP, GEP, AEP, and SEPs to avoid penalties and ensure continuous coverage. |

| Part D Coverage | Reviewing formularies, costs, and pharmacy networks for optimal prescription drug management. |

Frequently Asked Questions About Medicare in 2026

For 2026, significant changes are anticipated in premium and deductible amounts, potentially expanded preventive services, and further integration of telehealth options. There’s also a continued focus on efforts to reduce prescription drug costs, impacting Part D plans. Staying updated on official Medicare announcements is crucial to understanding these evolving aspects.

To avoid late enrollment penalties for Medicare Part B, you must enroll during your Initial Enrollment Period (IEP), which is the seven-month window around your 65th birthday. If you have employer-sponsored coverage, you might qualify for a Special Enrollment Period (SEP) when that coverage ends, allowing you to delay enrollment without penalty.

Medicare Advantage plans in 2026 are expected to offer expanded supplemental benefits, such as enhanced dental, vision, and hearing coverage, gym memberships, and healthy food allowances. There’s also a trend towards more specialized plans for chronic conditions and further advancements in telehealth services to provide comprehensive care.

The best time to review your Medicare coverage for 2026 is during the Annual Enrollment Period (AEP), which runs from October 15 to December 7 each year. This period allows you to switch Medicare Advantage plans, change Part D prescription drug plans, or switch between Original Medicare and Medicare Advantage, ensuring your plan aligns with your current needs.

For unbiased help with your Medicare decisions in 2026, you can consult your State Health Insurance Assistance Program (SHIP). These programs provide free, personalized counseling to Medicare beneficiaries. The official Medicare website, Medicare.gov, is also an excellent resource for comparing plans and understanding your options comprehensively.

Conclusion

Successfully maximizing your Medicare benefits in 2026 requires a proactive and informed approach. From understanding the evolving policy landscape and new coverage options to meticulously navigating enrollment deadlines and leveraging preventive care, every step plays a crucial role in securing optimal healthcare. By utilizing the available resources and continuously evaluating your needs, you can ensure your Medicare coverage remains robust, comprehensive, and perfectly aligned with your health and financial goals for the coming year.