Long-Term Care Benefits 2026: Federal & Private Planning

Understanding long-term care benefits in 2026 is essential for proactive financial and healthcare planning, as it involves navigating a complex landscape of federal support and private insurance options to secure future well-being.

Preparing for future healthcare needs is a significant concern for many Americans, especially as lifespans increase. Navigating the intricate world of long-term care benefits in 2026, which includes both federal and private programs, is crucial for ensuring peace of mind and financial stability. This article will guide you through the essential aspects of planning for these vital services.

Understanding long-term care: what it entails

Long-term care refers to a range of services designed to help people who are unable to perform basic daily activities on their own. This can be due to age, chronic illness, disability, or a cognitive impairment like Alzheimer’s disease. These services are not typically medical in nature but rather focus on assisting with daily living.

The scope of long-term care is broad, encompassing various settings and levels of support. It’s important to differentiate it from short-term medical care, which is often covered by traditional health insurance. Long-term care often involves extended periods of assistance, making its financial implications substantial for many families.

Types of long-term care services

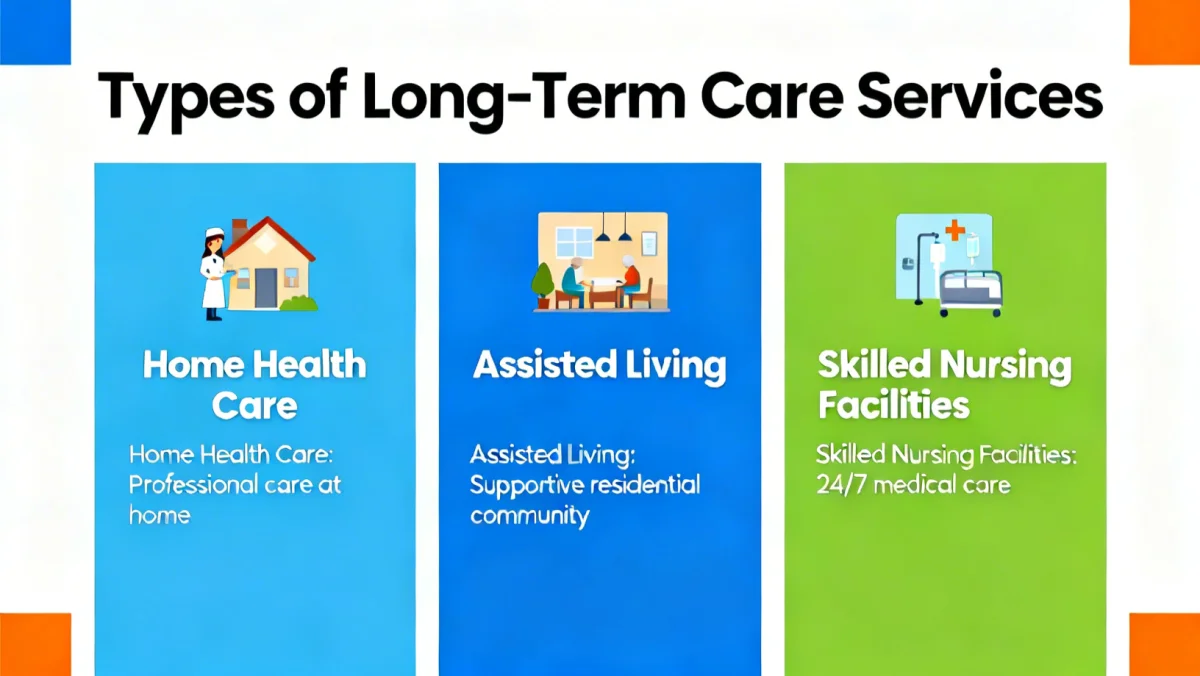

The services provided under long-term care are diverse and tailored to individual needs. Understanding these options is the first step in effective planning.

- Home health care: Assistance with daily activities in the comfort of one’s home, including personal care, light housekeeping, and medication reminders.

- Assisted living facilities: Residential communities offering personal care support, meals, and social activities for individuals who need some assistance but not 24-hour medical care.

- Skilled nursing facilities: Provides 24-hour nursing care and medical supervision for those with more complex health needs, often after a hospitalization or for chronic conditions.

- Adult day care: Supervised programs during the day for seniors who need assistance or supervision, allowing caregivers to work or take a break.

Each type of care offers different levels of independence and support, allowing individuals and their families to choose the most appropriate environment. The cost associated with these services varies significantly based on the intensity of care and the geographic location.

Federal programs supporting long-term care in 2026

While Medicare and standard health insurance typically do not cover extensive long-term care, several federal programs offer varying degrees of support. These programs are often needs-based or tied to specific circumstances, making eligibility a key factor in accessing benefits. Understanding these federal options is critical for comprehensive planning.

Medicaid is arguably the most significant federal program for long-term care, particularly for those with limited income and assets. It provides extensive coverage for nursing home care and, in many states, offers home and community-based services. However, eligibility rules are strict and vary by state, often requiring individuals to spend down their assets to qualify.

Medicare’s role in long-term care

Many people mistakenly believe Medicare will cover all their long-term care needs. In reality, Medicare’s coverage for long-term care is quite limited. It primarily covers skilled nursing care or home health care for a short period after a hospitalization, typically for rehabilitation, rather than ongoing custodial care.

- Skilled nursing facility care: Covered for up to 100 days under specific conditions, requiring a prior qualifying hospital stay and ongoing need for skilled services.

- Home health care: Covered for intermittent skilled nursing care, physical therapy, or other therapies, but not for non-medical personal care on a long-term basis.

- Hospice care: Covered for terminally ill patients, focusing on comfort and support rather than curative treatment, which can include some personal care services.

It is crucial to recognize these limitations to avoid unexpected financial burdens. For ongoing, non-medical long-term care, individuals must look beyond traditional Medicare benefits.

Medicaid and its expanded long-term care coverage

Medicaid serves as a vital safety net for millions of Americans, providing health coverage for low-income individuals and families. For long-term care, Medicaid is often the primary payer for nursing home care for those who meet financial and medical eligibility criteria. Its role has expanded over the years to include more home and community-based services, reflecting a growing preference for care outside institutional settings.

Eligibility for Medicaid’s long-term care benefits is complex, involving income and asset limits that vary by state. Many individuals must undergo a ‘spend down’ process, where they deplete their financial resources to meet these thresholds. This often involves careful financial planning, sometimes years in advance, to protect assets for spouses or dependents.

State-specific Medicaid waivers and programs

Beyond standard Medicaid, states often offer various waiver programs that expand coverage for home and community-based services (HCBS). These waivers allow states to provide long-term care services to individuals who would otherwise require institutional care, often with less stringent financial eligibility requirements than traditional nursing home Medicaid.

- Home and community-based services (HCBS): Programs that support individuals in their homes or community settings, including personal care, case management, transportation, and respite care for caregivers.

- Medicaid Estate Recovery: States are required to recover the costs of long-term care services from the estates of deceased Medicaid beneficiaries, which can impact inheritance for families.

- Look-back period: A period, typically five years, during which Medicaid reviews an applicant’s financial transactions to identify any asset transfers made to qualify for benefits, potentially imposing penalty periods.

Understanding the specific Medicaid rules and waiver programs in your state is paramount for accessing these critical long-term care benefits. Consulting with an elder law attorney or financial advisor specializing in Medicaid planning can provide invaluable guidance.

Private long-term care insurance: a crucial planning tool

Given the limitations of federal programs, private long-term care insurance (LTCI) has emerged as a crucial tool for many individuals planning for future care needs. LTCI policies are designed to cover a wide array of services, including home care, assisted living, and nursing home care, offering a financial safety net that government programs often cannot.

Purchasing LTCI typically involves paying regular premiums, and in return, the policy provides a daily or monthly benefit amount for a specified period once care is needed and eligibility triggers are met. The cost of premiums can vary significantly based on age, health, the level of coverage, and the specific features of the policy chosen.

Key features of private LTCI policies

When considering private LTCI, several features are important to evaluate to ensure the policy aligns with individual needs and expectations. These features directly impact both the cost of premiums and the comprehensiveness of coverage.

- Daily/monthly benefit amount: The maximum amount the policy will pay for care services each day or month.

- Benefit period: The total duration (e.g., 2 years, 5 years, lifetime) for which the policy will pay benefits.

- Elimination period: A waiting period (e.g., 30, 60, 90 days) after care begins during which the policy does not pay benefits, similar to a deductible.

- Inflation protection: An optional feature that increases the daily benefit amount over time to keep pace with rising care costs.

- Shared care option: Allows couples to share their combined policy benefits, providing flexibility if one spouse needs more care than initially anticipated.

Choosing the right private LTCI policy requires careful consideration of these features, balancing affordability with adequate coverage. Early planning typically results in lower premiums and a wider range of options.

Hybrid long-term care solutions and alternatives

Beyond traditional standalone LTCI policies, the market has evolved to offer hybrid solutions that combine long-term care coverage with other financial products, most commonly life insurance or annuities. These hybrid options aim to address some of the concerns associated with standalone LTCI, such as the potential for premiums to increase over time or the ‘use it or lose it’ perception.

Hybrid policies typically offer a death benefit if long-term care is never needed, or a specified long-term care benefit that accelerates the death benefit if care is required. Some also include a return-of-premium feature, ensuring that premiums are not entirely lost. This integrated approach can provide greater flexibility and peace of mind for those seeking comprehensive financial planning.

Understanding different hybrid options

The variety of hybrid products means that consumers have more choices, but also necessitates a deeper understanding of their structure and benefits. Each option comes with its own set of advantages and considerations.

- Life insurance with long-term care riders: A life insurance policy (often universal or whole life) that allows access to a portion of the death benefit to pay for long-term care expenses. If care is not needed, the full death benefit is paid to beneficiaries.

- Annuities with long-term care benefits: An annuity contract that provides a stream of income and can include a rider that doubles or triples the income payment if long-term care is needed.

- Cash value accumulation: Many hybrid policies build cash value over time, which can be accessed for other financial needs if desired, though this may reduce the death benefit or long-term care pool.

These hybrid products appeal to individuals who want the security of long-term care coverage but also value the guarantee of a death benefit or a return of premium. They represent an innovative approach to combining financial protection and healthcare planning.

Strategic planning for 2026: combining federal and private options

Effective planning for long-term care benefits in 2026 demands a strategic approach that often combines federal programs with private solutions. No single option provides a complete solution for everyone, and a personalized strategy is essential. This integrated approach can help mitigate financial risks and ensure access to the desired level of care when it becomes necessary.

Starting the planning process early is perhaps the most crucial step. The younger and healthier you are when you begin, the more options will be available, and the more affordable premiums for private insurance tend to be. Delaying decisions can lead to fewer choices and higher costs, or even being uninsurable due to health conditions.

Steps to a comprehensive long-term care plan

Developing a robust long-term care plan involves several key actions. These steps help individuals assess their needs, understand their options, and make informed choices for their future.

- Assess your needs and preferences: Consider your health status, family history, and personal preferences regarding where and how you would like to receive care.

- Evaluate your financial situation: Determine your current assets, income, and how much you can realistically allocate towards long-term care planning.

- Understand federal program eligibility: Research Medicaid and other state-specific programs to understand their eligibility requirements and potential benefits.

- Explore private insurance options: Investigate standalone LTCI and hybrid policies, comparing features, costs, and benefits from multiple providers.

- Consult with professionals: Engage financial advisors, elder law attorneys, and insurance specialists to help navigate the complexities and tailor a plan to your unique circumstances.

By taking a proactive and informed approach, individuals can build a comprehensive plan that leverages the strengths of both federal and private programs, securing their peace of mind and ensuring quality care in the years to come.

| Key Aspect | Brief Description |

|---|---|

| Federal Programs | Medicaid offers extensive coverage for low-income individuals; Medicare has limited, short-term benefits. |

| Private Insurance | Long-term care insurance provides broad coverage for various services, often with customizable features. |

| Hybrid Solutions | Combine long-term care benefits with life insurance or annuities, offering flexibility and potential death benefits. |

| Early Planning | Crucial for securing better rates and more options for long-term care coverage. |

Frequently asked questions about long-term care benefits

Traditional health insurance typically covers medical treatments for acute illnesses or injuries. Long-term care, conversely, is for assistance with daily activities and personal care over an extended period, which is generally not medical in nature.

Medicare has very limited coverage for long-term care. It primarily covers short-term skilled nursing care or home health services for rehabilitation after an acute medical event, not ongoing custodial care.

Medicaid is a significant payer for long-term care, especially for nursing home care for low-income individuals. Many states also offer home and community-based services through Medicaid waiver programs, though eligibility is strict.

Hybrid policies combine long-term care coverage with life insurance or annuities. They offer the benefit of long-term care funding while also providing a death benefit or return of premium if long-term care is not utilized.

The best time to start planning for long-term care is typically in your 40s or 50s. This allows for lower insurance premiums and more coverage options, as health conditions can make coverage more expensive or unavailable later in life.

Conclusion

Navigating the landscape of long-term care benefits in 2026 demands proactive engagement and informed decision-making. With the complexities of federal programs like Medicare and Medicaid, coupled with the evolving options in private insurance and hybrid solutions, a comprehensive strategy is not just advisable, but essential. By understanding the available resources, assessing personal needs, and consulting with financial and legal professionals, individuals and families can build a robust plan that ensures peace of mind and access to quality care when it matters most. Preparing today for the challenges of tomorrow is the most effective way to safeguard your future well-being.